Join

Various benefits come along with Society membership.

Renew

Please login by clicking the link or the button at the top of the page.

Advertise

For exhibtor information or to submit an ad, click here.

Career Opportunities

Please login to access the directory

CPA Verify

To check licensure (not all states participate)

Newsletter

Check out the latest issues of the Society Newsletters.

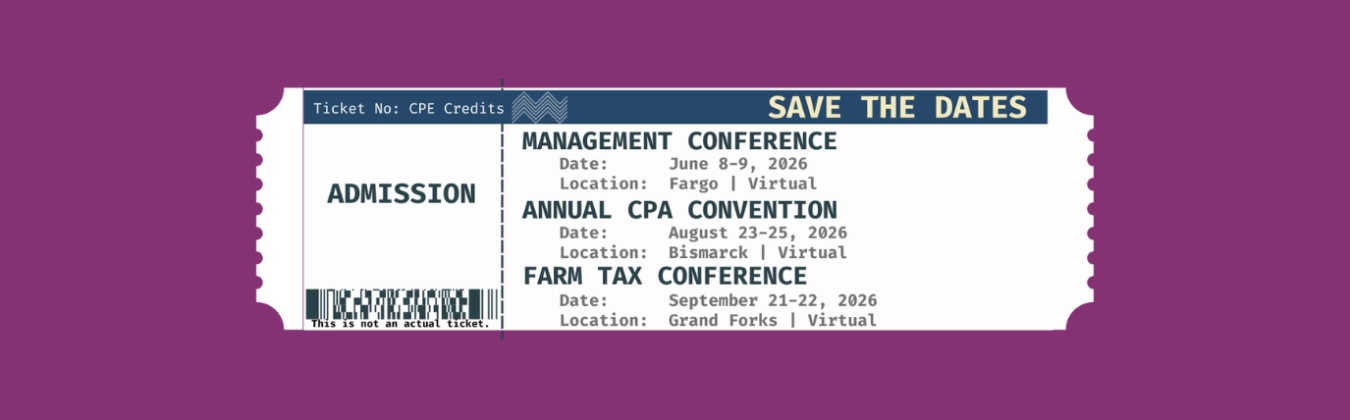

Upcoming Events

FREE Member Webinar: Pick Your Poison: Planning to Eliminate Death by a Thousand Taxes

Post OBBBA planning involves a careful analysis of which taxes need to navigate the estate planning ...

FREE Member Webinar: Mastering the Art of Advisory Meetings: Turn Data & AI into Client Breakthroughs (Sponsored)

Sponsored by The CFO Project

Advisory isn’t about just reporting numbers—...

Advisory isn’t about just reporting numbers—...

FREE Member Webinar: What were they thinking? Case studies in CPAs and Firms Behaving Badly

Do you think only bad CPAs and firms act unethically or do illegal things? This class draws up...